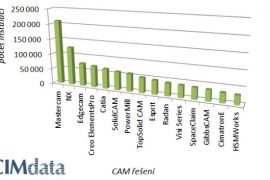

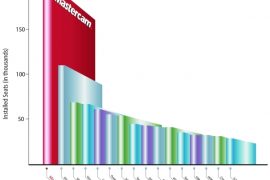

Konzultační organizace CIMdata zveřejnila výsledky průzkumu založeného na útratách koncových zákazníků používajících NC software a související služby.

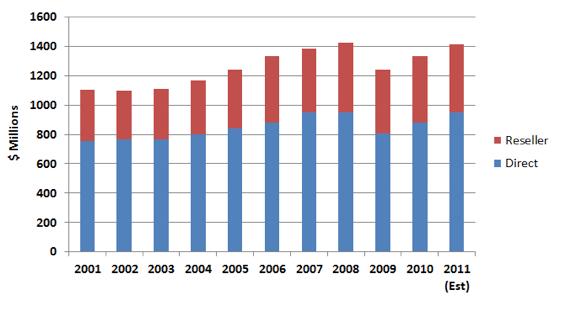

Odhadovaná výše útrat za tyto produkty v roce 2010 dosáhla 1,333 miliardy amerických dolarů, což oproti 1,239 miliardě dolarů za rok předchozí značí růst trhu o 7,6 %. Ten je efektem jednak celkového oživení trhu PLM řešení a zároveň reflektuje rozvoj prodejů obráběcích strojů ve strojírenství, které vloni meziročně vzrostly o 21 % a dosáhly částky 66,3 miliardy dolarů. CIMdata odhaduje, že tento trend bude pokračovat a pro letošek si trh s NC softwarem polepší o dalších 6 % směrem k částce přesahující 1,4 miliardy dolarů.

Sledovaný segment roste pomalu, ale stabilně od roku 2002 v souladu s rozvojem globální ekonomiky. Propad zaznamenal až v roce 2009 v důsledku celosvětové ekonomické krize.

Graf mimo jiné odhaluje, že zhruba třetinu příjmů z NC softwaru generují jeho místní distributoři (Reseller), přičemž většina příjmů je směřována přímo na účty výrobců (Direct).

Graf mimo jiné odhaluje, že zhruba třetinu příjmů z NC softwaru generují jeho místní distributoři (Reseller), přičemž většina příjmů je směřována přímo na účty výrobců (Direct).

(Zdroj: Tisková zpráva)

CIMdata Reports that NC Software Market Grew by 7.6% in 2010

July 01, 2011

NC Market Returns to Growth as Part of Global Rebound

ANN ARBOR, Michigan, 28 June 2011—CIMdata, Inc., the leading global PLM consulting and research firm announces that based on end-user spending, the worldwide NC software and related services market grew by 7.6% in 2010. The estimated end-user spending grew from $1.239 billion in 2009 to $1.333 billion in 2010. The increase in the market growth in 2010 reflected the rebound in the global economy, and the return to overall growth of the Product Lifecycle Management market. This is also reflected in the increase in global machine tool sales into the manufacturing industry, which grew 21% to $66.3 billion in 2010 over the 2009 estimate of $57.4 billion. Going forward, CIMdata projects that the rebound in manufacturing will continue, and estimates that end-user spending for NC software will increase by 6% in 2011 to $1.412 billion.

Since 2002, the NC software market has shown modest but steady growth as global economies generally improved. There has been worldwide growth in the sale of machine tools and manufacturing output; greater emphasis has been placed on the efficient operation of machine tools as manufacturing firms have strengthened their competitive position, and the overall PLM (Product Lifecycle Management) market, of which CAM software is a component, has continued on strong growth during this period. CAM software purchase increases are related to all of these factors—particularly machine tool sales.

The size and growth of the NC software and related services market based on end-user payments is shown in the chart below.

The chart illustrates that approximately one-third of the end-user spending results from reseller revenues, and the other two-thirds are direct payments to software vendors.

The above information is contained in the soon-to-be-issued Version 20 of the CIMdata NC Market Analysis Report. Mr. Stan Przybylinski, CIMdata’s Director of Research commented, “2010 saw recovery in the manufacturing sector, and software investments soon followed. This is consistent with our results from our global PLM market analysis.” Mr. Alan Christman, CIMdata’s Chairman and long-time author of the NC Market Analysis Report continued, “2009 was a difficult year for manufacturers and most providers of NC software. Most firms saw good growth in 2010, and CIMdata expects this growth to continue in 2011 and beyond. The growing strength and importance of global manufacturing powers like China and other emerging economies should result in increased investment in advanced technologies like CAD, CAM, and other segments of the overall PLM market. As importantly, there is some move to bring manufacturing back to the US, which will require still more investment in advanced manufacturing technologies to be competitive with economies with lower labor costs. The next few years should be really interesting for NC and the broader PLM market.”